OUR INVESTMENT CONTINUUM

TZ HEALTHCARE – VENTURE INTEGRATOR

We integrate throughout the continuous investment process – from technological viability to market commercialisation and expansion.

Our investment drive focuses on disruptive medical technology leading to healthier living for tomorrow’s ageing population, especially in the field of digital diagnostics and therapeutics.

Customised Investments

From pre-seed to step-up rounds to more mature institutional investment funds (like TZPBC Healthy Ageing Impact Venture Fund).

Customised Structuring

Founders’ equity structure, team structure, funding stewardship, and investor relations are important considerations we help advise.

Customised Commercialisation

Through our Market Readiness Platform, our invested technologies are validated in proving grounds of hospital and nursing home environments to strengthen commercialisation viability further.

OUR INVESTMENT CONTINUUM

TZ HEALTHCARE – VENTURE INTEGRATOR

We integrate throughout the continuous investment process – from technological viability to market commercialisation and expansion.

Our investment drive focuses on disruptive medical technology leading to healthier living for tomorrow’s ageing population, especially in the field of digital diagnostics and therapeutics.

Customised Investments

From pre-seed to step-up rounds to more mature institutional investment funds (like TZPBC Healthy Ageing Impact Venture Fund).

Customised Structuring

Founders’ equity structure, team structure, funding stewardship, and investor relations are important considerations we help advise.

Customised Commercialisation

Through our Market Readiness Platform, our invested technologies are validated in proving grounds of hospital and nursing home environments to strengthen commercialisation viability further.

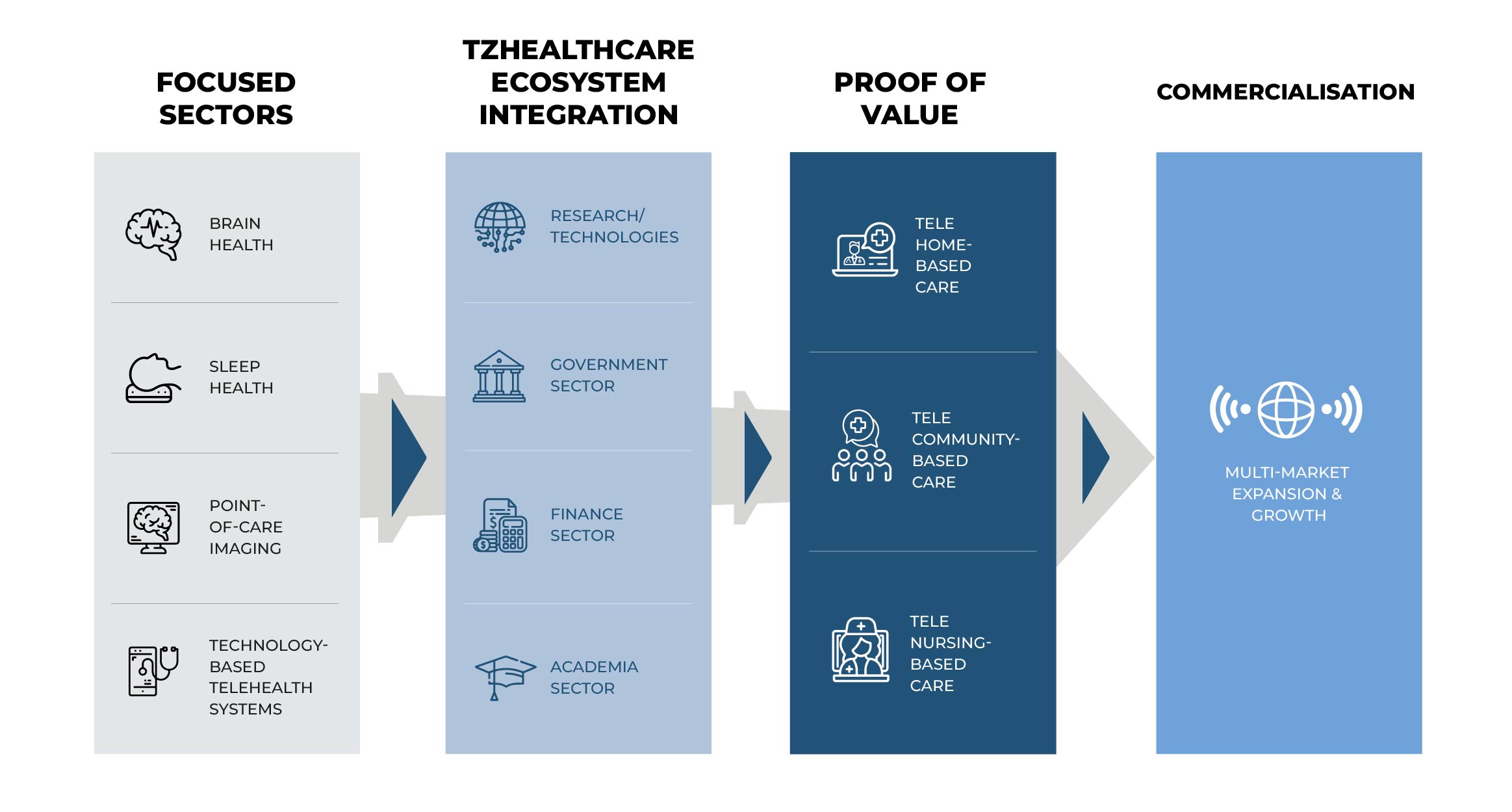

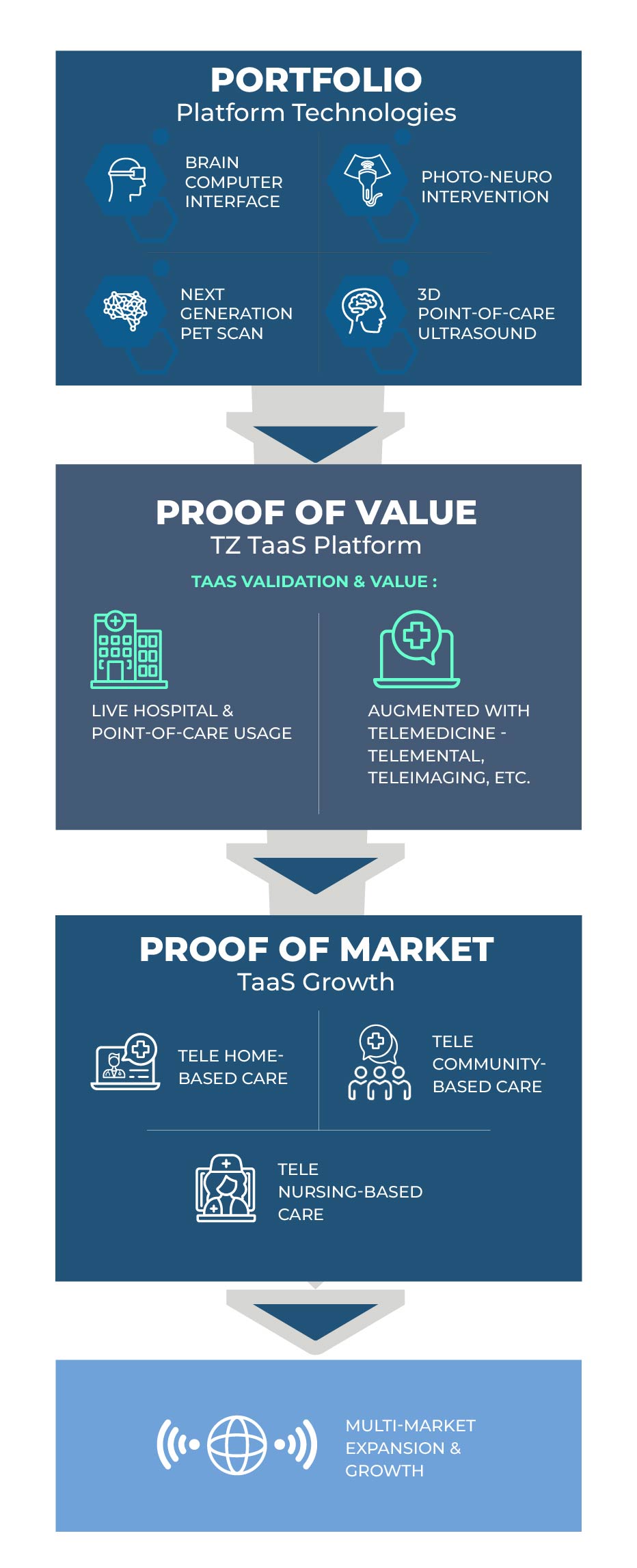

TZ HEALTHCARE VENTURE INTEGRATOR MODEL

TZ HEALTHCARE VENTURE INTEGRATOR MODEL

Our TECHNOLOGICAL PARTNERSHIPS and ventures specialise in brain health digital therapeutics, next-generation PET scans, and higher-resolution 3D ultrasound imaging.

Brain Computer Interface (BCI) centres on ADHD, Parkinson’s and dementia therapeutics.

Photo-Neuro Intervention (PNI) enables photoactive treatments inside the brain.

Next-generation organ-targeted PET devices that are mobile, have a higher definition, sensitivity and low dose.

Next-generation point-of-care 3D Ultrasound.

TECHNOLOGY PORTFOLIO

As our population ages at a faster rate than before, more medical innovations are focusing on proactive early detection and disease deferment increasing better quality aged living.

Our technology portfolio reflects this trend of seeking and employing more digital diagnostics and therapeutics for the aged especially in the brain health space.

Global Brain Therapeutics Market

CAGR – 12.5%

brain computer interface

(bci)

The invested technology focuses on sleep disorders, stroke, and ADHD (Attention Deficit Hyperactivity Disorder).

Its core technology is a platform OS that empowers health care professionals, researchers and third-party developers with an Artificial Intelligence (AI) driven platform with the ability to analyse users’ brain signals, measuring mental states including but not limited to attention, relaxation, mental workload and fatigue. The holistic platform, coupled with its other offerings, reveals numerous avenues as complementary options for ADHD children, stroke rehabilitation, cognitive rehabilitation and many other neurological challenges.

The invested technology focuses on sleep disorders, stroke, and ADHD (Attention Deficit Hyperactivity Disorder).

Its core technology is a platform OS that empowers health care professionals, researchers and third-party developers with an Artificial Intelligence (AI) driven platform with the ability to analyse users’ brain signals, measuring mental states including but not limited to attention, relaxation, mental workload and fatigue. The holistic platform, coupled with its other offerings, reveals numerous avenues as complementary options for ADHD children, stroke rehabilitation, cognitive rehabilitation and many other neurological challenges.

- Clinically validated by A*STAR

- Investors: Ryoden Medical Limited & TZ Healthcare

- Round Size: USD 2,000,000

- Status: Series A++

PHOTO-NEURO INTERVENTION

(PNI)

Our invested technology is a one-of-a-kind patented implantable light-activated therapy system capable of suppressing or halting the recurrence of neurodegenerative diseases, including:

- Brain tumours

- Parkinson’s

- Epilepsy

- Depression Anxiety

- Cognition

Targeted wireless photo-stimulation has been demonstrated to induce neuroprotective effects and is a revolutionary development and versatile PIN platform to enable photoactive treatments inside the brain.

Global Medical Imaging Market

CAGR – 5.8%

NEXT GENERATION PET

(Positron Emission Tomography)

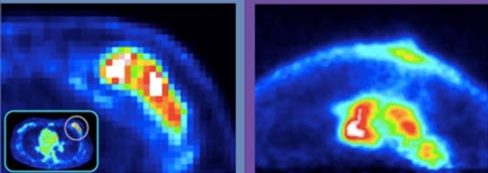

Image of the same breast of the same patient. Left image – normal scan. Right image using low dose PET, hi-definition, organ target imaging.

This next-generation disruptive imaging technology creates better diagnostic opportunities in neurology, oncology, cardiology, and rheumatology over current PET scan capabilities

- Novel sensors close to the target organ

- High sensitivity

- High definition

- Versatile – mobile & economical

- Low dose

- FDA approved

POINT-OF-CARE (POC) 3D ULTRASOUND

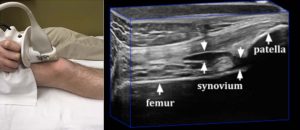

Left : Image of the 3DUS scanner used to image the knee.

Left : Image of the 3DUS scanner used to image the knee.

Right : Cross-section of a wrist 3DUS acquisition of a knee displaying relevant anatomical structures and mild effusion synovitis.

POC diagnostic imaging systems are brought to the patient rather than moving the patient to the hospital. Three-dimensional (3DUS) diagnostic imaging systems are based on significant unmet clinical needs and the lack of availability of integrated diagnostic POC systems.

- Portable: Used in a point-of-care setting in a clinic, long-term care facility, and home care.

- Credibility: Partner with world leading Medical Imaging Institute (CIMTEC)

- Software platform: Easily adaptable to a wide range of clinical applications.

- Cost effective: Significantly less expensive than the offerings from the major ultrasound vendors.

- Integrated machine learning tools: To provide the presence and location of the pathology as well as volume measurements needed for assessing cancerous lesions in less than a second.

- Interfaced with any available 2D ultrasound machine: Adapt to the traditional system to reduce the barrier to introduce into the clinic or hospital.

- Applications include Carotid Plaque Quantification, Osteoarthritis & Rheumatoid Arthritis diagnosis, Oral Cancer, Dense Breast screening, & Thyroid Cancer screening.

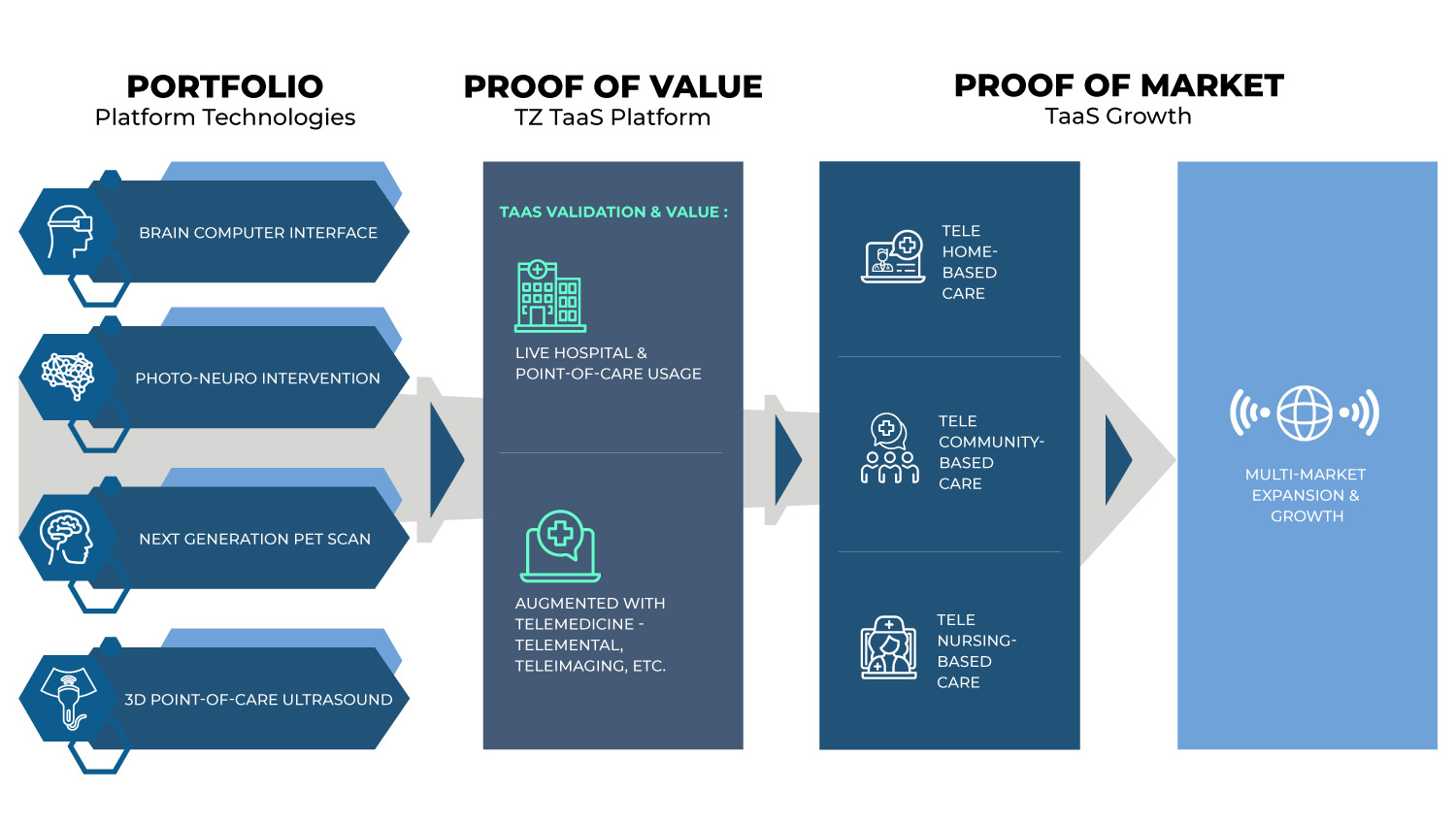

BUILDING THE NEXT GENERATION TELEHEALTH SYSTEM

TeleHealth systems will be the benchmark of future patient care. However, it must transcend just video conferencing features to real-time digital solutions coupled with breakthrough medical technologies.

TZ Healthcare envisages the next generation Technology-as-a-Service (TaaS) TeleHealth systems to include such technologies as brain health, sleep and preventive care, and next-generation imaging systems. As a result, Telecare systems can be more cost-effective through technology integration, efficiency, and scale.

TZ Healthcare sees TeleHealth systems to include TeleMental, TeleSleep, TeleImaging, etc., as more medical technologies arise, driven by advancing AI-powered data systems.

As a result, Telecare systems can be more cost-effective through technology integration, and effectiveness for both clinicians and caregivers.

BUILDING THE NEXT GENERATION TELEHEALTH SYSTEM

TeleHealth systems will be the benchmark of future patient care. However, it must transcend just video conferencing features to real-time digital solutions coupled with breakthrough medical technologies.

TZ Healthcare envisages the next generation Technology-as-a-Service (TaaS) TeleHealth systems to include such technologies as brain health, sleep and preventive care, and next-generation imaging systems. As a result, Telecare systems can be more cost-effective through technology integration, efficiency, and scale.

TZ Healthcare sees TeleHealth systems to include TeleMental, TeleSleep, TeleImaging, etc., as more medical technologies arise, driven by advancing AI-powered data systems.

As a result, Telecare systems can be more cost-effective through technology integration, and effectiveness for both clinicians and caregivers.

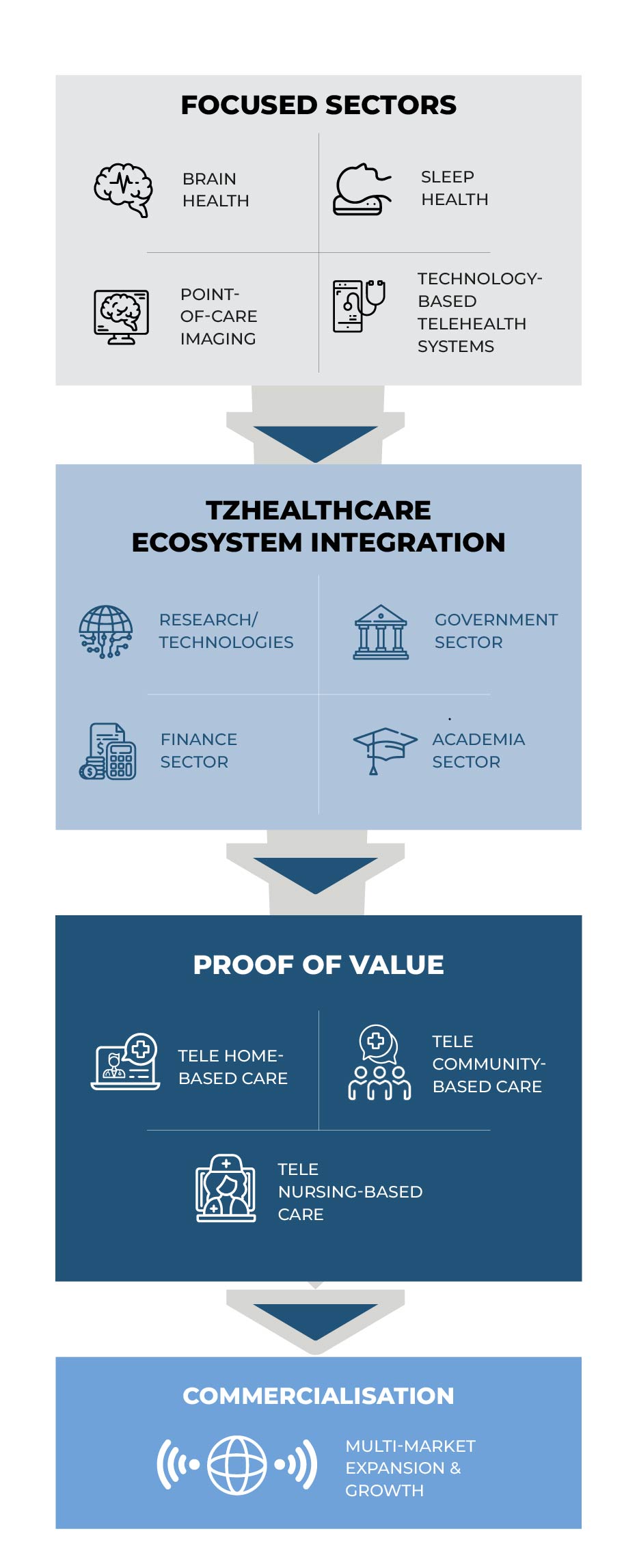

MARKET-READINESS TaaS PLATFORM

TaaS - Technology-as-a-Service platform is a purposefully developed telemedicine system where each new technology is integrated into an AI database hence proving the technology’s validation and value.

MARKET-READINESS TaaS PLATFORM

TaaS - Technology-as-a-Service platform is a purposefully developed telemedicine system where each new technology is integrated into an AI database hence proving the technology’s validation and value.

SINGAPORE AS A

LAUNCH PAD

The greatest asset Singapore offers to Asia is its population. Singapore represents 80% of the ethnic people of Asia. As a crucible for medical innovation, systems, research and finance, the ability to innovate and represent the rest of Asia is a significant strategic asset. Singapore-developed medical innovations – readied for Asia and the world.

Medical health research for ethnic Asians is multiplying, complementing and growing the diagnostic and therapeutic regimes of western-based solutions. The more significant ensuing opportunity is for AI-powered Asian databases will be the new Asian medical frontier.

Singapore’s pro-business environment offers increasing coordinated efficiencies among the various stakeholders, both private and public sectors, regulatory, academia, and technologists.

SINGAPORE - ASEAN - GREATER BAY AREA CONNECTIVITY

According to Enterprise Singapore (ESG), there is growing diversity of Singapore firms taking advantage of connectivity in the Guangdong-Hong Kong-Macao Greater Bay Area.

Greater Bay Area (GBA) accelerated their push into new hi-tech manufacturing and industries, which will shape the economic and manufacturing powerhouse of the 21st century, contributing more than 10% of China’s GDP. GBA’s compelling proposition is a highly skilled talent pool and a pro-tech innovation environment.

The Singapore-Guangdong Collaboration Council (SGCC) was established in 2009 to foster partnerships focused on innovative technologies and “knowledge-intensive’ projects.

ASEAN is China’s largest trading partner, with Singapore as the leading trade and financial centre, having a pivotal role in that relationship. China has had a positive experience adapting Singapore’s management models. In particular, the healthcare system of Singapore, with its forward-thinking technology integration and well-known cost-effectiveness, will have an advantage in playing a leading role in the healthcare system.

SINGAPORE - ASEAN - GREATER BAY AREA CONNECTIVITY

According to Enterprise Singapore (ESG), there is growing diversity of Singapore firms taking advantage of connectivity in the Guangdong-Hong Kong-Macao Greater Bay Area.

Greater Bay Area (GBA) accelerated their push into new hi-tech manufacturing and industries, which will shape the economic and manufacturing powerhouse of the 21st century, contributing more than 10% of China’s GDP. GBA’s compelling proposition is a highly skilled talent pool and a pro-tech innovation environment.

The Singapore-Guangdong Collaboration Council (SGCC) was established in 2009 to foster partnerships focused on innovative technologies and “knowledge-intensive’ projects.

ASEAN is China’s largest trading partner, with Singapore as the leading trade and financial centre, having a pivotal role in that relationship. China has had a positive experience adapting Singapore’s management models. In particular, the healthcare system of Singapore, with its forward-thinking technology integration and well-known cost-effectiveness, will have an advantage in playing a leading role in the healthcare system.

OUR LEADERSHIP AND NETWORK RESOURCES

These include medical academia, medical practitioners, healthcare entrepreneurs, investment funds, and financial advisors from significant healthcare centres in the US, Canada, the UK, Finland, Greater China, Singapore, and Hong Kong.

LEADERSHIP

Dr. Aaron Fenster

Dr. Aaron Fenster

contact us

- 160 Robinson Road #14-04 Singapore Business Federation Centre Singapore 068914

- contactus@tz-healthcare.com

Get in touch with us for partnership and investor relations matters.

Email us or submit this form.